Telephone : 400-123-4567

Tencent not only distributed money in a high-profile manner on the occasion of Double Eleven when Alibaba encouraged everyone to spend money, but now the high-growth business of the financial report is just right to match Alipay and Alibaba Cloud.

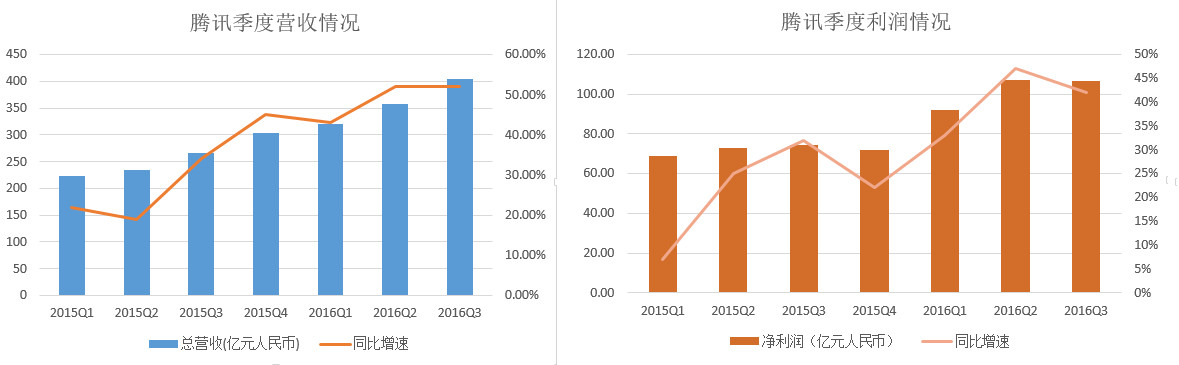

This evening, Tencent released today's unaudited third quarter earnings report. The report shows that Tencent's total revenue in the third quarter increased by 52% year-on-year, the same growth rate as the previous quarter; net profit growth has declined.

It is worth noting that the proportion of Tencent's game revenue has declined for two consecutive quarters, with online game revenue accounting for only 45% of total revenue in the third quarter; while the proportion of emerging businesses such as payment and cloud computing continued to rise, exceeding 10% for the first time, reaching 12%.

In terms of overall financial position, Tencent's total revenue in the third quarter was RMB 40.388 billion (US $6.048 billion), an increase of 52% year-on-year, and the growth rate was the same as the previous quarter. However, the profit growth rate slowed, and the profit in the period was RMB 10.776 billion (US $1.614 billion), an increase of 42% over the same period last year. Net profit margin fell to 27% from 29% in the same period last year.

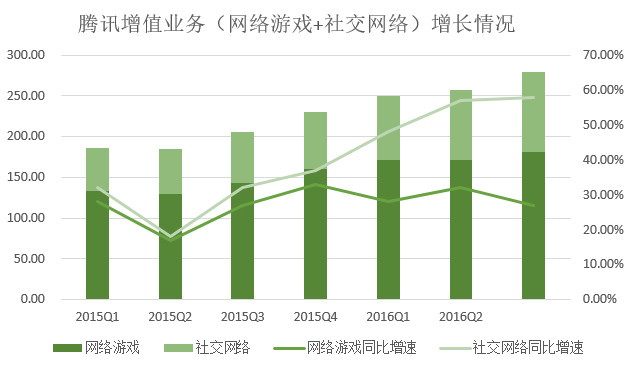

In terms of segment business, value-added services, including online games and social networks, continue to account for the majority of Tencent's revenue, accounting for about 80%. However, the game business, which has always been regarded as Tencent's cash cow, has declined for two consecutive quarters, and now accounts for only about 45% of total revenue. The business once accounted for 60% of Tencent's revenue in 2015. The growth rate of social network revenue is gradually increasing, and the proportion has been stable at 23-24%.

Looking closer, mobile games have become the main force of the game business, in the game business revenue of 18.10 billion yuan, mobile games are 9.90 billion yuan, an increase of 87% year-on-year; the end game revenue growth of only 10%, and according to the financial report, the end game The average online user has declined at the same time, therefore, Tencent is focusing on increasing the user's time in the game to expand user interaction.

The share of online advertising revenue was also relatively stable, accounting for about 17% of the group's revenue. Among them, the revenue of performance advertising increased significantly, with a growth rate of 83%, mainly due to the contribution of advertising revenue from WeChat Moments, mobile end news applications and WeChat public accounts. WeChat is also constantly exploring ways to monetize Moments, including its recently launched Moments' LBS local promotion advertising and native promotion page advertising.

In addition, in the context of QQ monthly active users (877 million, up 2% from the same period last year) peaking, the combined monthly active accounts of WeChat and WeChat continue to grow, reaching 846 million, up 30% from the same period last year. However, compared with the number of MAU users of QQ, if WeChat fails to further internationalize, its user peak is obviously not far away, so WeChat's current focus is no longer on increasing WeChat users, but on figuring out how to keep users on WeChat and spend all their time in the app. Therefore, WeChat is testing the "Mini Program", which allows users to interact with WeChat at a low frequency without leaving the WeChat interface.

The most eye-catching growth was in other businesses, including payments and Cloud as a Service, which rose 348% year-on-year to RMB 4.964 billion. At this point, the proportion of other businesses in group revenue has reached 12%, exceeding 10% for the first time.

Ali and Tencent are already two payment giants in China. The former relies on e-commerce, while the latter relies on social networking, and has launched many payment reduction wars. Alipay has recently gone overseas frequently, and Tencent has also begun to layout the payment market in South East Asia after Alipay.

At the same time, although the specific income of Cloud as a Service has not been disclosed, even Alibaba Cloud, which is a dominant player in the domestic public cloud market, accounts for only 4% of Alibaba's total revenue. In addition, this market has just begun. Tencent, which has strong capital, has its own advantages in the vertical field of games and the meaning of layout in the field of artificial intelligence. It is not difficult to catch up.

In this way, although Tencent has suffered setbacks in the field of e-commerce and the film industry has not made any major moves in Alibaba, it may still have to face a few bloodshed battles with Tencent in the two star businesses of payment and cloud computing.

400-123-4567

138-0000-0000